Get Started In Minutes

CALL 215-820-5435

What is a CPA?

A certified public accountant (CPA) is an accounting professional who has met specific educational, examination and experience requirements for licensure by a state board of accountancy. CPAs are members of the American Institute of Certified Public Accountants and required to follow strict standards the AICPA has established.

What is the difference between a CPA and a regular accountant?

CPAs and regular accountants can prepare tax documents but only CPAs have the authority to represent clients in front of tax authorities, such as the IRS in the event of an audit. Also CPAs can send a CPA comfort letter pertaining to financial statements to banks while regular accountants cannot.

What’s unique about 1on1CPA?

Affordable services: We deliver premium CPA services without the premium price.

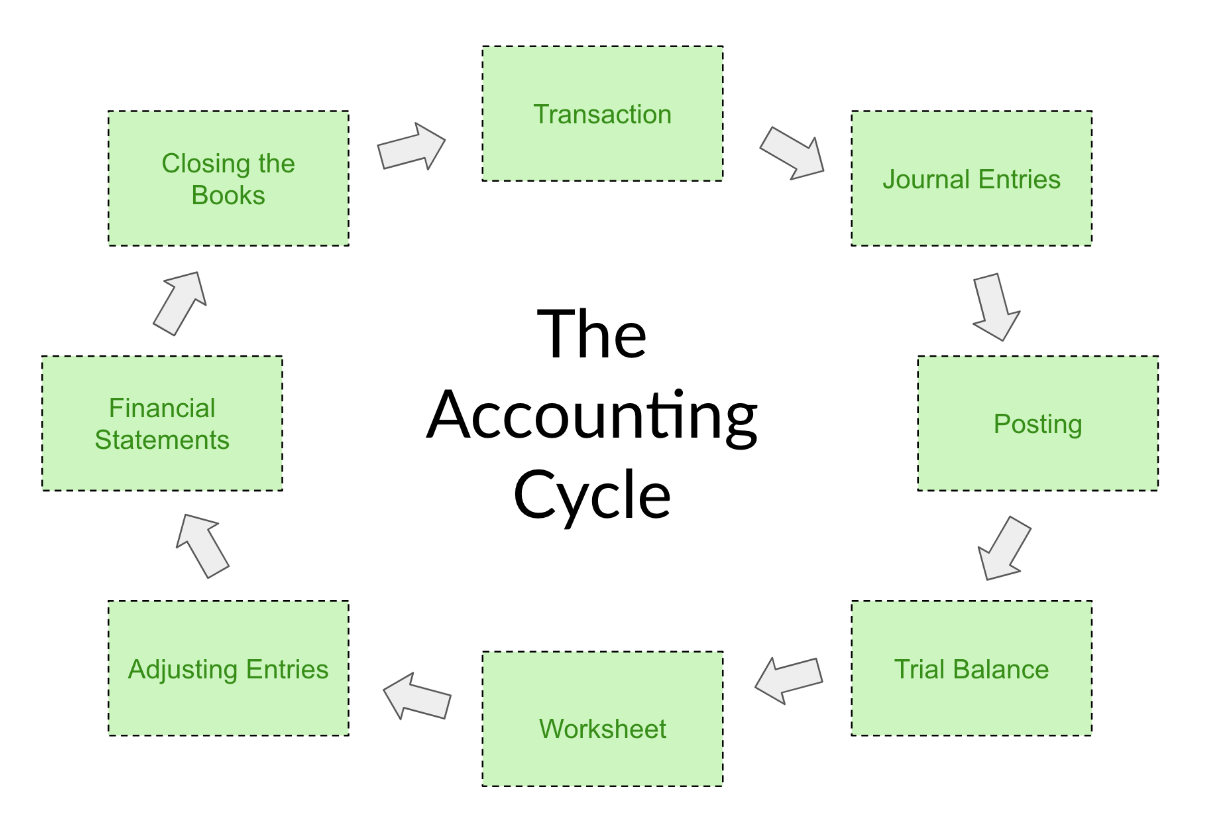

Accounting & Bookkeeping: At 1on1CPA, every task is thoroughly reviewed by a CPA. Our team has extensive experience and expertise in Generally Accepted Accounting Principles (GAAP) and tax regulations.

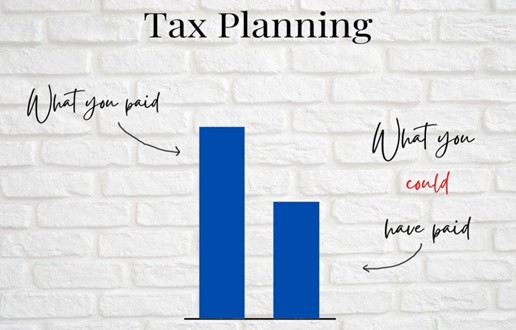

Tax planning & preparation: We specialize in serving small businesses, by implementing tax saving strategies that are traditionally only used for high net-worth individuals.

Personalized guidance: We are recognized for our personalized attention and tailoring comprehensive solutions to our client’s specific needs.

Accessible support: Many firms claim it, but we truly deliver. Our team is dedicated to promptly addressing your questions and concerns, offering accessible one-on-one support.